Binance vs Ethereum: The Quick Explainer You Need

Binance is a cryptocurrency exchange that has its own blockchain. Ethereum is a decentralized blockchain. A pivotal factor dividing Binance and Ethereum is decentralization. Ethereum has always been a decentralized network, while Binance’s network is highly centralized. This is mainly due to the different consensus mechanisms that are adopted by the two networks.

Where it all Began

The two networks have had an unusual beginning. Ethereum was created in 2014 and was initially just an idea by a nineteen-year-old developer. From a tiny idea to build a resilient technology to quickly getting to a team of over eight founders, Ethereum saw rapid growth. The purpose for which Ethereum was created was for its ability to delimit the functionalities that Bitcoin itself had. The idea was to create a blockchain on which several other applications (that is other protocols) could be built – something that was not permissible with the bitcoin was created.

Binance (launched in 2017), on the other hand, was initially a mere exchange whose primary goal was to provide trading capabilities to users. Within 45 days of its launch itself, the exchange had over 122K users and a daily participation rate of over 50%. This rapid growth cemented its position within the market.

Funding

Both Ethereum and Binance had very successful ICOs. Ethereum raised over $18M in its ICO (Initial Coin Offering) while Binance raised over $15M in its ICO of BNB (Binance Coin, the native coin on the Binance network).

A crucial thing to note here is that both Ethereum and Binance were only expanding on the existing technology within the ecosystem. That is, they were the next milestone in pushing the boundary of decentralized finance forward, but they were not the first to do so.

Over the years, Binance’s aggressive expansion strategies have enabled it to stand out and outcompete all other exchanges. Consequently, it launched its own blockchain, the Binance Chain, and in 2020 they released another network called the Binance Smart Chain (BSC), which is a new blockchain and is functionally similar to Ethereum.

Binance vs Ethereum: The Battle for Decentralisation

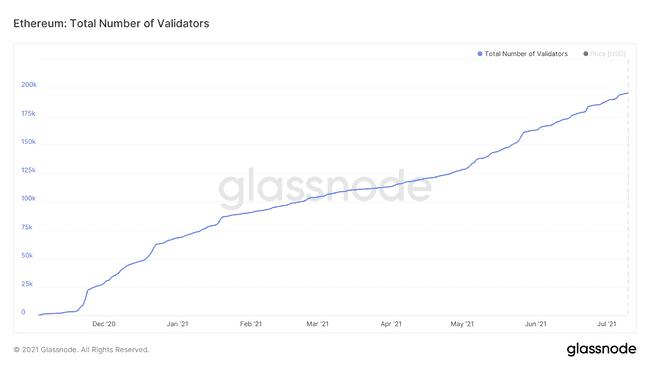

A crucial factor distinguishing the two networks is decentralization. While Ethereum is highly decentralized with hundreds of thousands of validators spread across the globe, Binance has an upper limit of only 21 validators.

But why does the number of validators on a network matter? In any decentralized network, due to a lack of a centralized authority approving/disapproving transactions, there is a need for the community to collectively vote on those transactions that are valid and should be included in the blockchain, and those that are not. This is usually done by specialized computers that are further run by users who are participating within the network. These users who help validate different transactions on the network are known as validators. Naturally, in a decentralized network, the more the number of validators the more secure it is.

Because the number is more in Ethereum, it is considered to be much more decentralized than Binance. Thus the number of validators participating in the consensus mechanism on the network determines its performance.

The lesser the validators, the more transactions the network processes every minute.

More Transactions, Better User Experience

Because of the 21 main validators on BSC, it offers a much-enhanced experience to users because transactions are processed quite quickly. The quicker the transactions happen, the more users are going to use the applications built on the network. To put things into perspective, Ethereum processes about 15 TPS (transactions per second) whereas BSC offers over 50 TPS.

Higher TPS, Lower Costs

A user who wishes to transact on any network is required to pay the transactional costs for the same. These costs generally depend on the complexity of a transaction (for instance, if you simply wish to buy BNB or ETH, then the transactional costs would be much lower as compared to other complex transactions such as supplying liquidity). Naturally, when a small number of transactions are being processed each second, the validators on the network are going to charge more per each.

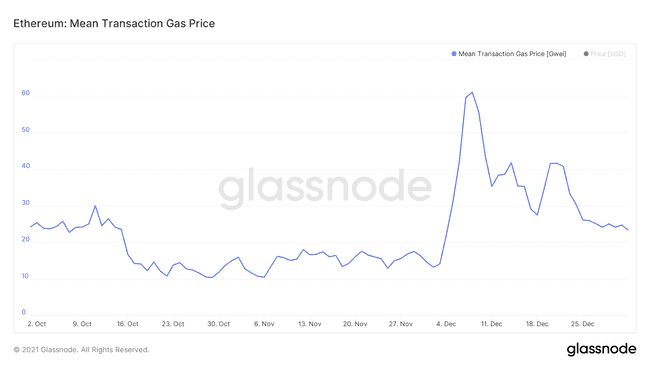

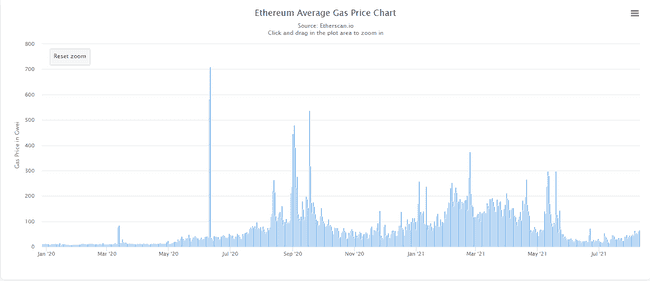

Thus, during extremely active periods on any network (such as during a bull market), the transactional costs on Ethereum go extremely high. To give an example, when Cryptokitties - the first NFT game on Ethereum - was launched, the transactional costs had gone to record highs.

To put things into perspective, when a lot of users are transacting on the network all at once, the transactional prices (also known as gas fees on Ethereum) can go up to $50 even if you only wish to simply buy a coin for $10!

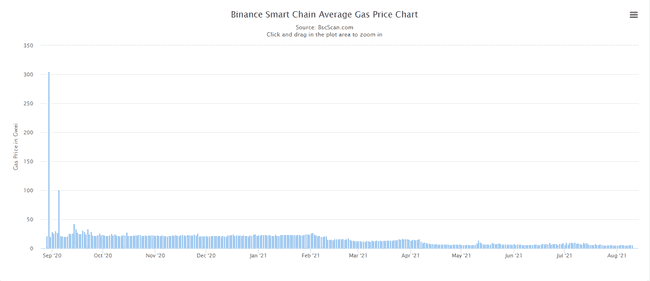

Over the past year too, BSC had much lower gas fees than that on Ethereum.

Lower Costs, More dApps

As a consequence of lower transactional costs on a network, it is quite natural for both developers and users to flock to use the decentralized applications (dApps) on the network where transactional costs are low. This is why, between 2020 and 2021, we have seen more users migrating to BSC and using the dApps that are available on the network.

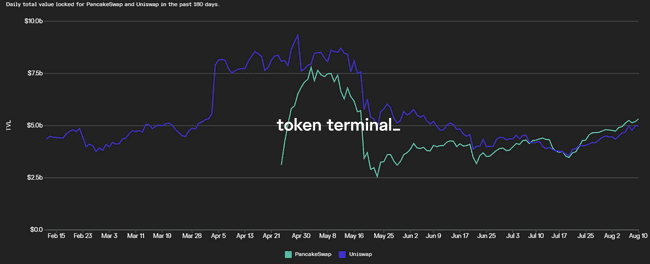

For example, let’s consider two major dApps on Ethereum and BSC. Both are decentralized exchanges; the first (built on Ethereum) is Uniswap and the second (built on BSC) is PancakeSwap. As is visible from the charts, the total value locked (total value locked; indicative of the number of assets “locked” within the network) on Uniswap has been steadily falling, whereas that on PancakeSwap has been increasing.

Can Binance outcompete Ethereum?

No, it cannot. A crucial thing that we must understand is that Ethereum is wholly decentralized - which means that no single point of attack/failure on a validator can affect the entire network. The only reason why Ethereum is unable to process an increasing number of transactions is that it is currently running on previous technology. However, soon it is going to upgrade to Ethereum 2.0, which will ensure that it is able to process over 100,000 transactions per second.

While users and many developers have been fond of BSC for a while because if offers higher transaction throughput, it is still not decentralized. If anyone were to attack 11 validators on the network, the entire BSC network could be compromised. Therefore, regardless of the number of applications that are migrating to BSC, the truth is that Ethereum will be everyone’s go-to blockchain once the upgrade happens.