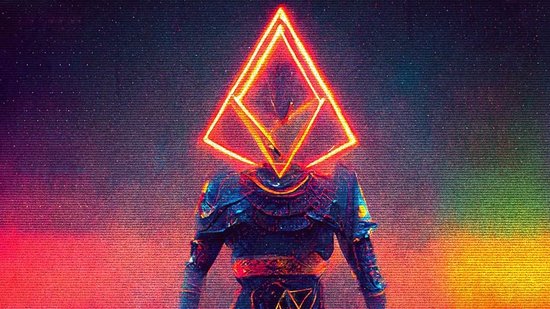

What is Ethereum merge?

On September 15, 2022, the transition to a new mechanism for processing transactions on Ethereum, the second-largest blockchain network, was successfully accomplished. The conversion from proof-of-work (PoW) to proof-of-stake (PoS) on the Ethereum network has been in the works for several years; nevertheless, fluctuating timeframes, scrapped plans, and conflicting messaging from Ethereum’s core developers have generated basic doubts about what it all means.

What exactly is Ethereum merge

This upgrade to Ethereum, which is being referred to as “Merge,” modified the manner in which new cryptographic currency transactions are recorded on the blockchain.

In the past, the Ethereum blockchain, much like the Bitcoin blockchain, operated using a concept known as proof-of-work. This model requires nodes, which are individual computers that are connected to a larger network, to compete with one another to solve difficult mathematical problems. Those that are successful are then able to mine the subsequent block of a transaction and produce additional currencies.

Due to the upgrade, Ethereum is now operating on the proof-of-stake structure, which is a protocol that is friendlier to the environment and uses less power. It involves selecting nodes through the use of an algorithm that gives precedence to nodes that possess a greater amount of a network’s currency than any other nodes.

Check also: Ethereum Gas Price Monitor

Difference between proof-of-stake (PoS) and proof-of-work (PoW)

The methods used by proof-of-stake (PoS) and proof-of-work (PoW) to determine who has the privilege to log the following “block” of network transactions are different.

In the current proof-of-work (PoW) Ethereum system, like Bitcoin, miners race to publish blocks by cracking cryptographic riddles. The validators that stake (lock up) at least 32 ether (about $50,000) with the network are chosen at random to construct blocks in the forthcoming PoS system. One is more likely to be chosen the more ether they stake.

The block-winning miner or validator in both systems is rewarded with a combination of transaction fees and freshly created ether (ETH). Additionally, PoS validators are rewarded for undertaking additional network security measures.

Check also: Total Used Gas Fee Price Calculator

Reason for Ethereum network transition

Because of the shift, the Ethereum network will be able to cut its overall energy consumption by almost 99%.

Proof-of-work is the model that is used on the Bitcoin network. This model demands a significantly higher amount of energy than the proof-of-stake model. The negative impact that cryptocurrency transactions have on the natural world has been at the forefront of the minds of many critics and supporters of cryptocurrencies alike. Ethereum’s transition to the less energy-intensive proof-of-stake algorithm is seen as a significant step forward in this regard. It will also provide the framework for other aspects of the network’s future, such as making transactions more efficient, which will be set in motion as a result of this.

Working of Ether Staking

After the Ethereum Merge, node validators will have to stake (or lock up) 32 ETH into a smart contract as collateral in order to be eligible for block rewards. This Ether will be locked up until a network update makes withdrawals possible.

Ethereum manages incentives by holding a random lottery to choose who will suggest a new block to be added to the blockchain, in contrast to certain PoS blockchains that provide a better chance of rewards to users who stake a bigger amount of cryptocurrency.

According to Ethereum, “when validator withdrawals are permitted, stakers will be encouraged to remove their earnings/rewards (balance over 32 ETH) as these monies are otherwise not contributing to their stake weight (which maxes out at 32).”

Anyone who wants to stake ether but does not have 32 ether or does not want to host a validator node can do so by joining a staking pool. To stake the requisite 32 ETH for an Ethereum validator node, a stake pool pools the deposits of several people. The staking pool then receives a percentage of the block rewards from that node based on the amount of ETH that was initially invested per user account.

A variation of this is also available on cryptocurrency exchanges, where users may stake tiny sums in exchange for a set payout.

Check also: The Best Crypto Signals Providers

The Merge of Ethereum Has Risks

The planned Ethereum Merge, which is the largest upgrade to a cryptocurrency blockchain network to date, has a number of hazards. The following are some of the dangers of the Ethereum Merge:

-

Vulnerability to a Denial-of-Service (DoS) Assault

For instance, if a potential attacker is waiting in line to propose one of the following blocks in the blockchain, they can try to perform a DoS (a sophisticated networking attack) on the current proposer’s node, which will make them lose their slot and allow the attacker to pick up the transactions in that slot. Although there are methods for making the proposer selection anonymous in the works, there is still a danger.

-

Centralization of Staked ETH

Staking pools have gained popularity since most investors don’t have the necessary 32 Ether to stake but may join a group to gather the money necessary to become a validator. As a result, there may be a greater concentration of validator nodes under the control of centralized organizations, increasing the possibility of censorship or a takeover of governance.

-

Frauds

This has caused misunderstanding about whether ETH 2—a freshly created cryptocurrency—will exist and renders ETH holders vulnerable to frauds. Scammers may attempt to take advantage of this confusion by convincing users to exchange their existing ETH for “ETH 2,” but in reality, they would be taking the user’s ETH.

-

Decline in price of ETH

A decline in the price of Ether, as well as several other popular cryptocurrencies whose platforms were built on top of the Ethereum blockchain, might result from difficulties with the merger.