Stop Loss - A Quick Guide

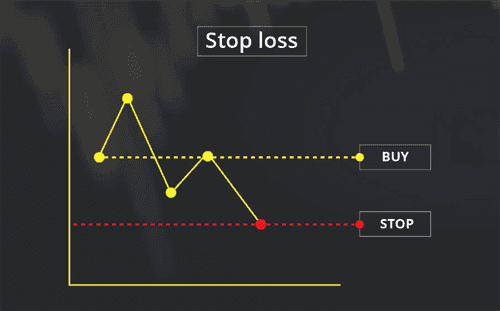

A stop loss is a common trading tactic used by beginner-level traders that helps cut losses by liquidating assets once they reach a pre-specified value.

A bit complex to understand? Don’t worry. Stop loss is actually one of the easiest (and possibly the most helpful) concepts in trading and is often employed by both beginner- and advanced-level traders to cut their losses. In this article, we will explore what stop loss is, what are its various types, and why it is one of the most useful tactics in crypto trading.

Stop loss - Stopping Incremental Losses

Let us say that you bought a cryptocurrency at $20. You are quite certain that the price of your coin will keep rising through the next few hours. In fact, in the next few hours, it does seem to get to $22, $25, and even touches $28. Let’s say that you have invested $1000 in this coin. Your profits are steadily increasing and you hope that this upward movement continues.

However, after hitting a resistance at $28, the price starts falling and within a couple minutes falls back to $20. You naturally are confused whether to sell off those coins or hold on to them. Your conviction tells you that the price can still rise, so you hold on to your position. And within a few hours the prices drops to $5. You have lost about 300% of your initial investment. Had you closed your position at $17, your loss would have been minimal. This is where stop loss comes in.

You can set your broker/exchange to have a stop loss at a specified percentage or a price. So, for instance, if your stop loss limit is $15, then your exchange automatically closes your position once the price falls to that point. This helps in saving you from incremental losses.

When can I use a stop loss?

A stop loss can be used after understanding how the market is moving and whether prices are seeing an incremental or a decremental movement. Understanding the movement of the asset beforehand is crucial to implement a stop loss, as some assets might see a momentary decline and then suddenly jump back up. While it is hard to predict these scenarios beforehand, more experienced traders can do it.

For beginners, stop loss can be used whenever they are unsure about the future movement of the price, or if they have invested a considerable amount of money in the asset. A common instance where stop loss will help cut losses is given below.

Is there just one type of stop loss?

No, stop losses vary from full to partial to trailing. In a full stop loss, all assets are liquidated once the specified price point has been attained. This is especially useful in case of coins that are highly volatile. Further, this type of stop loss is often employed by beginner-level traders.

Partial stop loss is when a part of the traders’ assets are still left while the remaining part are liquidated. This ensures that the trader still has the position open on the asset, in case it bounces back after the fall. While this type of stop loss is useful in cases of highly volatile cryptocurrencies, they can also turn out to be potentially dangerous as the non-liquidated assets can be lost if the coin keeps falling.

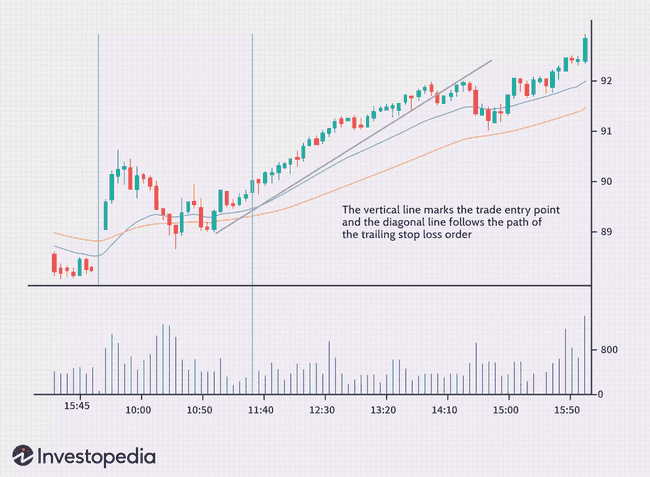

Trailing stop loss is when the value of stop loss is dynamic and adjusts to the price of the asset in real time. The trader is asked to specify a trailing distance, which is the difference between current asset price and the stop loss value. If the price of the asset increases, it is followed by an increase in the stop loss, however if it falls then the stop loss value remains the same.

While each of these types of have their own benefits, trailing stop loss is considered the better one because the trader does not have to adjust the stop loss according to the market. However, again, full stop loss is considered the go-to for beginners as in a worst case scenario, it can help the trader from losing all their assets.

Why is stop loss useful in crypto?

If anyone has been trading on the crypto market regularly, then they would be aware that the prices of tokens/cryptocurrencies on the market are highly volatile. While a particular asset might give you the false hope that it will continuously keep rising, there are cases where the price of the asset can plummet leaving you with a loss of over 50%. Thus, to help protect traders from losing their funds to a highly volatile market, stop loss is one of the safest strategies.

However, it has its downsides as well.

It can be the case, sometimes, that a particular asset’s price devaluation is just a precursor to its further rise. For instance, in the graph below, if a trader opens a position at about 10:00 AM, then within a couple minutes a full stop loss will be triggered and they will be able to save themselves from an incremental loss. However, this proves counterproductive because by lunch the price is seeing a continuous rise.

While this is a commonplace scenario, trailing stop loss can be used to ensure that the stop loss value rises along with the rise in prices. If the trailing distance is carefully set, then this can turn out to be a profitable trade.

Can stop loss also be risky?

Setting the stop loss value too high or too low in case of a full stop loss can be detrimental as the trader will either make the slightest profit or stand to lose a lot of their assets. This is also true for partial stop loss as it still risks a part of your assets. Setting the trailing distance is key in trailing stop loss. If the distance is too low, then a steadily rising asset can be liquidated too quickly.